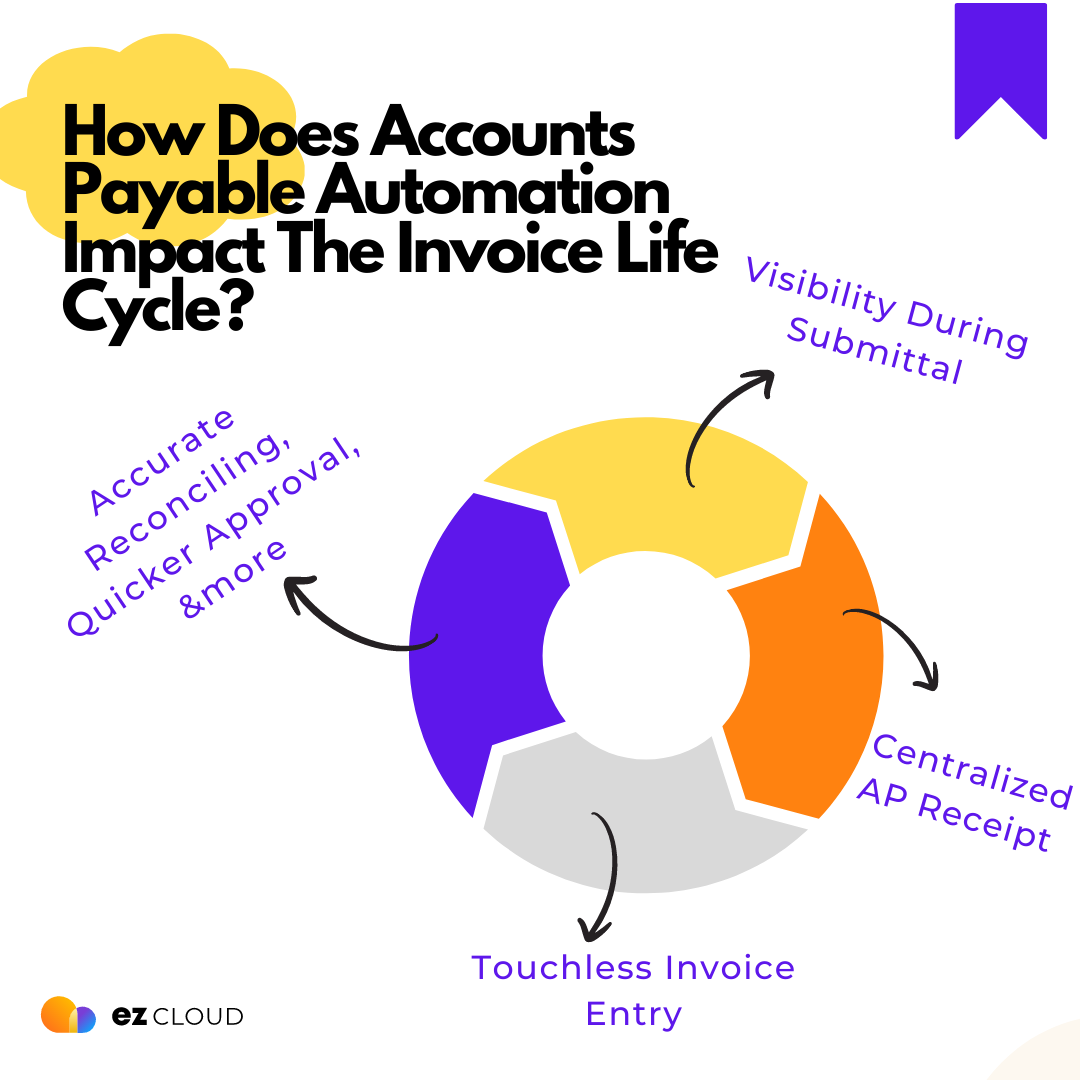

Accounts payable automation leads the charge as the number one way to streamline the invoice life cycle. AP automation impacts the submittal, receipt, entry, reconciling, approval, and payment stages of the invoice life cycle, saving time and human capital.

Your staff will have more time to tackle year-end duties, B notices, and 1099 audits while still being able to take an actual lunch break.

Shortening the invoice life cycle does more than increase staff morale. It also looks good on paper if you need to bring your company’s days payable outstanding ratio (DPO) into an acceptable industry range (3).

Let’s examine how automation works AP magic throughout the invoice life cycle.

Visibility During Submittal

Accounts payable automation allows vendors to upload their invoices directly. Offering vendors transparency into the payment cycle yields a warmer vendor relationship (2). This transparency translates to fewer vendor calls to your AP team regarding payment status.

Centralized AP Receipt

Touchless invoice processing streamlines how invoices are received. The likelihood of losing or misplacing invoices decreases by routing them through one centralized portal instead of receiving them through multiple branch locations (1).

The ability to instantly download invoices also means no lag time due to slow mail delivery. Quicker receipt eliminates missing out on payment term discounts.

Touchless Invoice Entry

Remember the days when a typo or transposition could mean the difference between leaving on time and getting stuck in gridlock traffic when finalizing the check run?

Accounts payable automation increases accuracy by capturing invoice data without manual entry. Automated AP systems also decrease the likelihood of duplicate entry. No more time spent getting a vendor to refund a duplicate payment or explaining to auditors why an invoice was paid in triplicate due to human error.

AP automation also decreases GL coding errors, saving you time when you’re getting ready to close the month and produce financial reports.

Accurate Reconciling

Reconciling an invoice and proofing three-way match documents are no longer functions your staff needs to groan about. Customized exceptions handling and fraud alerts also let your AP team know immediately if a problem requires a human superhero to save the day—or clear the exception.

Touchless invoice processing also means less opportunity for someone to commit fraud. Machines don’t hold grudges or embezzle on their own.

Quicker Approval

Accounts payable automation impacts the approval process by simplifying it and eliminating the need for wet signatures while maintaining a clean audit trail (2).

Approval reminders assist in keeping multi-approval structures on track. The system does the initial dirty work of reminding directors they have outstanding invoices to approve, not your staff.

Payment approval flows effortlessly and may not require multiple reviews, depending on your organization’s AP process.

Timely Payment

AP automation directly impacts a company’s bottom line by getting payments out on time and eliminating costly interest and late fees because your team has a bird’s eye view of what needs to be paid and when.

What does this all mean?

Accounts payable automation positively influences the invoice life cycle and has the opportunity to make a significant impact on your team and what they focus their attention on.

Share your newfound AP automation savviness with your business circle. After all, happy controllers equal happy companies.

Sources: